Coinbase a Decentralized

While some may consider Coinbase to be a decentralized exchange, the fact remains that it is a monopoly. As a result, it faces acute risks related to market forces, including the potential for a cryptoasset’s value to plunge in a downturn. Because it depends on transaction fees from retail investors, it is particularly exposed to market volatility. In addition, it is directly exposed to risk when interacting with more volatile cryptoassets, such as Bitcoin.

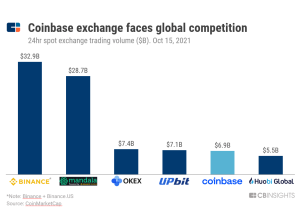

Aside from its monopoly, Coinbase has been challenged by other companies in the crypto industry, including Uniswap, Curve, and Blockchain. While these companies are innovative and promising, they have all been subject to large-scale hacks. Despite these challenges, the monopoly continues to grow. While the lack of a centralized exchange makes cryptocurrencies more expensive to purchase, many have remained loyal to Coinbase. However, some competitors have come along and are putting up strong competition.

Coinbase’s monopoly status comes from the fact that it has no control over how the coins are traded. There are no regulators or exchange operators to monitor or regulate the market, so Coinbase’s popularity remains a significant challenge to the company. As a result, Coinbase has embraced this situation and has begun building an institutional infrastructure to help institutional investors participate in the crypto markets. As such, Coinbase plans to expand beyond the United States.

Is Coinbase a Decentralized Exchange?

A decentralized exchange makes it easy to add liquidity to any crypto asset or token. The platform also allows for token launchpads for project founders to enter the market. As a result, anyone can launch their own tokens and add liquidity, potentially getting ahead of the curve. A Decentralized trading such as Coinbase has a small list of assets and uses USD and ETH as base pairs. As such, Coinbase is not a decentralized exchange, but a unified platform.

As a decentralized exchange, Coinbase’s primary goal is to increase its customer base, which is a significant advantage over a decentralized exchange. The key to increasing customer base is a broader range of assets, which can be more accessible. It is crucial to have a diverse ecosystem to avoid fraud. A large number of assets, such as stablecoins, are traded through a single platform.

A decentralized exchange makes it easy to add liquidity and trade any cryptocurrency. Token launchpads allow project founders to enter the market and add liquidity. The ability to launch tokens and trade them ahead of the curve is a critical advantage for a decentralized exchange. While the list of assets is limited on Coinbase, it is worth using it if you are considering crypto. Its free trial will allow you to try it out and learn about it.