Carbon Credit Exchanges Real

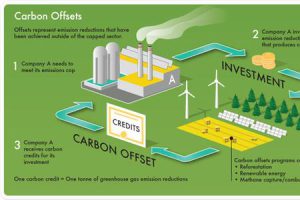

Carbon credit exchanges are digital marketplaces that allow buyers and sellers to buy and sell carbon credits. They are an important tool for businesses to offset their greenhouse gas emissions. These exchanges also provide a venue for global investors to invest in the economy, helping to move the economy toward more sustainable practices.

When companies make a commitment to reduce their greenhouse gas emissions, they purchase carbon credits to offset their emissions. The value of these credits depends on the carbon credit exchange project. Some projects offer social benefits that can add value to the credit. Projects are generally categorized by their geography, size, and type. However, value is also determined by supply and demand.

A company can either purchase credits from a carbon project or it can create its own. Many financiers and project developers have a brokering arm that allows them to buy and sell credits. Companies can also sell their excess credits to other participants.

Are Carbon Credit Exchanges Real?

In addition to carbon credit exchanges, there is a voluntary market. This is a market that operates independently of federal oversight. It is a voluntary market that is focused on meeting international climate goals. Unlike a regulated carbon market, the voluntary market does not impose a cap on the number of tons of CO2 emissions.

The voluntary carbon market has grown in recent years, thanks in part to increased corporate net-zero goals. More industry sectors are looking for ways to hedge the financial risks associated with the transition to a clean energy future. As a result, more and more companies are participating in the voluntary market.

Carbon credits can be sold on digital exchanges, though there is considerable scrutiny surrounding these transactions. A few carbon credit exchanges have begun to emerge, though they are still relatively new. There are several factors that affect the prices of carbon credits, including the underlying project, the amount of time it takes to deliver the credit, and the type of attributes that are included in the credit.

Prices of carbon credits vary widely depending on the underlying project. For example, a community-based reforestation project will trade at a higher price than an industrial project. Also, the geography of the underlying project affects the cost of the carbon credit. Industrial projects tend to produce large volumes of credits, while community-based projects are smaller in size.

Carbon projects are complex. Most are not well defined and rarely have a set of specific standards. If a project is not delivering on its promises, the value of the credit will be affected. But many of these projects are managed by local communities and can be more costly to certify.

The traditional carbon market is based on individual projects. Although it can be helpful to reduce emissions, it is often complicated and hard to get an accurate estimate of the value of the credits. ACX, for instance, is a carbon trading platform that leverages recent blockchain technology to securitize carbon credits. ACX uses a digital warehouse to store assets, which allows investors to manage and invest in the assets.