How Do Fear and Greed Affect

The emotions of fear and greed can affect the decisions of investors in the stock market. They often steer investors away from the right investments and into costly mistakes.

There are many indicators that can help you track market sentiments and make investment decisions based on those factors. One of the most widely referenced is CNNMoney’s Fear and Greed Index, which gauges the levels of these two emotions in the market.

It measures seven different sentiment factors, such as stock price momentum; junk bond demand; and safe-haven demand. The index doesn’t take technical or fundamental analysis into account to a great extent, but it does give you a sense of how fear and greed are affecting the market.

How Do Fear and Greed Affect the Decisions of Investors?

The CNN Fear and Greed Index is a quantitative measure of the levels of fear and greed in the market. This indicator is a good way to gauge sentiment in the market and identify irrational markets.

Using this indicator can help you determine whether the market is overvalued or undervalued and to avoid buying shares at the wrong time. It is also a useful tool to monitor stock prices and determine when it is appropriate to sell your stocks.

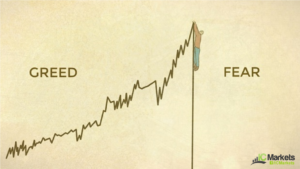

When a stock is in a bear market, it is usually in a state of extreme fear. This means that investors are worried about the stock and might be tempted to sell at a low price. On the other hand, when a stock is in a bull market, it is usually in a state if extreme greed and might be a good time to buy.

In the long term, these emotions may not be as important as valuations and earnings, but in the short term they are just as critical. This is why it is important to keep an eye on the level of these two emotions in the market and understand how they can affect your decisions.

Investors should consider these emotions before making any investment decisions, and they should always stick to their asset allocation plan no matter what the sentiment indicators might be. This will help ensure that they don’t lose money based on emotion and that they don’t get caught in a lurch when the market is irrational.