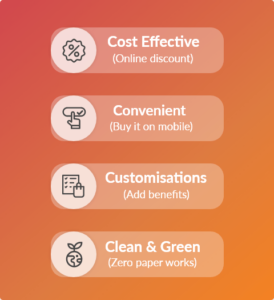

Benefits of Buying Health Insurance Plans Online

In addition to a lower monthly premium, purchasing your health insurance online can give you more flexibility and freedom when choosing which doctors and clinics you will visit. You can also check whether your preferred physician is part of the network before purchasing your plan. You can end up paying more for care if you go outside of your plan’s network, so you must consider that before choosing a plan.

When buying a health plan online, you should be aware of the cost of out-of-pocket expenses. Read the benefits summary carefully to understand your coverage and out-of-pocket costs. Also, take note of the copayment and deductible amounts. A copay is a flat fee for services, while a coinsurance is a percentage of the medical charges. In addition, you must pay a deductible before the insurance starts paying.

When you purchase a plan online, you can also compare prices from many providers. By comparing rates, you can determine which insurance is the best deal for you. This will help you narrow down your search and avoid those plans that don’t cover certain doctors or medicines.

High deductible plans are ideal for individuals who do not visit a doctor frequently or buy prescription medication. They still cover emergency care, and a high deductible will help you pay less in the long run. However, a high deductible plan is not always the best choice for individuals who spend a lot of money on medical services.

What Are the Benefits of Buying Health Insurance Plans Online?

When shopping online for your medical insurance, it is important to understand the coverage you need. Each policy has its own deductibles and copays, and some of them cover preventive care. You can even choose a family plan with separate deductibles for each family member.

When you compare health insurance plans online, you will want to consider all of the coverage levels, provider networks, and insurance companies. You will also want to pay attention to the cost of the premium, out-of-pocket maximum, and monthly deductible. These three factors are important when comparing prices, because they determine how much you will be paying each month to cover health care expenses.

The open enrollment period for marketplace plans is November 1 through December 15 every year. You can purchase coverage outside of the open enrollment period only if you have a change of life, such as getting married, divorced, or adopting a child. In addition, you can qualify for premium tax credits if you purchase an ACA-compliant health insurance plan.

The policy covers seasonal illnesses. There is a thirty-day waiting period before services related to pre-existing conditions are covered. Many policies also cover pre-existing conditions. These include diabetes, high blood pressure, and heart and lung problems. Some policies have a three or four-year waiting period. If you have any of these conditions, it is best to purchase your policy as soon as possible.

Bajaj Finserv offers a comprehensive medical coverage through a number of policies. Whether you are planning to go for a routine checkup or an emergency procedure, there’s a plan for you. bajaj finserv health insurance is ideal for anyone looking to receive medical care at a lower cost than usual. Many of its policies provide cashless medical care or EMIs. You can choose the tenor of the repayment and set up a payment schedule to fit your budget. The policy also covers dental and eye care and maternity services.